Without a will, you have no say over how your assets are distributed after your death, which could lead to unintended outcomes and complications for your loved ones. Despite this, just

44% of UK adults have a will, leaving a significant portion of the population vulnerable to intestacy laws upon their passing.

To discover more about wills in the UK and people’s attitudes toward them, we leveraged AI-driven audience profiling to synthesise insights from opinions that were expressed online to a high statistical confidence level. Our audience consisted of 118,578 people whose responses were collected over the course of a year, ending December 12, 2024. From this data, we determined audience attitudes and what they reveal regarding the current sentiments about wills across the UK.

Index

- Just 4.1% have a will

- Nearly 50% cite fear of death as reason for not making a will

- Executor selection the biggest challenge for 56.8% of our audience

- 49.8% made a will to ensure business succession

- 62.2% believe a wills main benefit is protecting beneficiaries

- Over 80% would prefer to create a living trust

- Nearly 50% name investments as most significant assets

- Over 50% of our audience is unmarried

- Over 65s have highest engagement levels by just 0.7%

- Men nearly 5% more likely to make wills than women

- About the Data

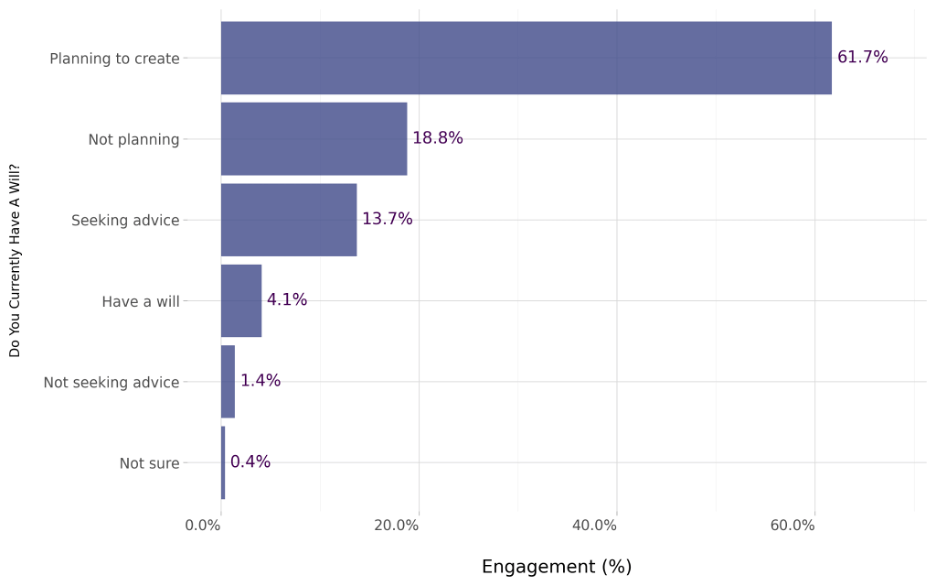

Do You Currently Have A Will?

Just 4.1% have a will

While over half of the audience plans to create a will, an alarmingly low number actually have a will. The below graph reveals just how few people have planned for the future:

Our data showed that of the 11,578 people in our profiled audience, only 4.% have a will. This means that just about 474 have their affairs in order for after their passing. What’s more alarming is that 0.4% were not sure about having a will, 1.4% were not seeking advice about having one written, and 18.8% were not planning to do so, either.

However, what is positive is that the highest engagement numbers were recorded for those who were planning to create a will (61.7%) and the third highest for seeking advice (13.7%), so there is an awareness of the need for a will.

According to The Gazette, the reluctance to write a will is still prevalent in the UK, with a survey revealing that 56% of adults had not written one. This means that the majority of people’s estates are distributed in accordance with UK intestacy law, meaning that they have no say over the distribution of their money, property, and possessions.

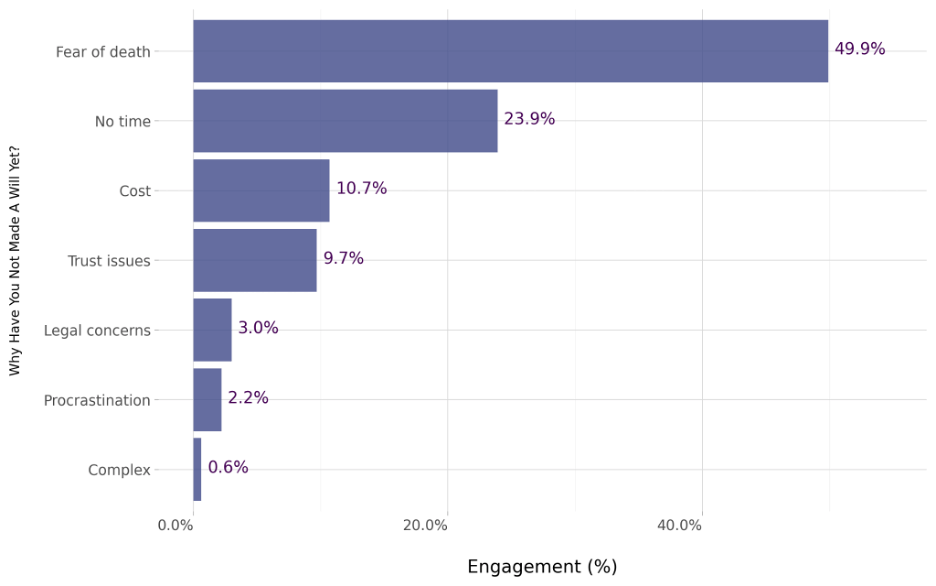

Why Have You Not Made A Will Yet?

Nearly 50% cite fear of death as reason for not making a will

Fear of death is the biggest motivator behind not having a will, while time and cost are also major factors. Here’s what our data shows:

With 49.9% citing fear of death as a reason for not having a will, it’s clear that this was the biggest concern for our audience. However, another survey of 2000 UK adults found that this was only the reason for 13% of their respondents and that the highest proportion (24%) believed they didn't have enough wealth to warrant needing a will.

Where the survey and our audience did align closely was with cost. In the survey, 15% said that cost was their reason for not making a will, and 10.7% of our audience said the same. While cost is a consideration, charities in the UK have been working hard to mitigate this with Free Wills Month. Every March and October, charities offer those over the age of 55 the opportunity to have a simple will drafted for free.

However, in addition to a fear of death and lack of time, we also found that 23.9% of our audience cited a lack of time as the reason for not having a will, 9.7% had trust issues, 3% had legal concerns, and 2.2% were simply procrastinating. Just 0.6% cited making a will too complex as the reason, highlighting that complexity is not a significant barrier for most individuals.

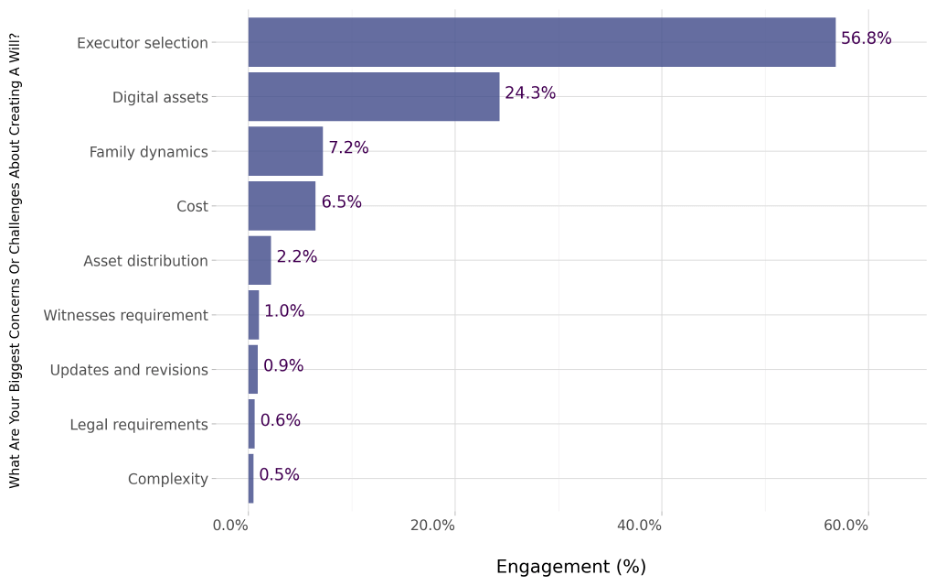

What Are Your Biggest Concerns Or Challenges About Creating A Will?

Executor selection the biggest challenge for 56.8% of our audience

More than half our audience name executor selection as the toughest part of drawing up their will, with the graph below outlining the other major concerns and challenges faced:

Although you can appoint up to four executors for your will, this is the biggest challenge our audience faces. 56.8% say that selecting an executor is a hindrance, which is 32.5% more than the second biggest concern of digital assets (24.3%). In today’s world, digital assets play a huge role in our lives, and planning for what happens to them after you die can be very complex. However, if you do not leave instructions for them in your will, they may lead to legal issues, which won’t be ones that are covered by succession but by intellectual property law instead.

Despite the ever-growing number of will disputes, family dynamics garnered relatively low engagement levels of 7.2%, followed by cost (6.5%). Asset distribution was barely registered as a concern at 2.2%, followed by witness requirement at 1%. Dropping below 1% were updates and revisions (0.9%), legal requirements (0.6%), and complexity (0.5%), all of which fall into the administration category rather than having emotional or familial ties.

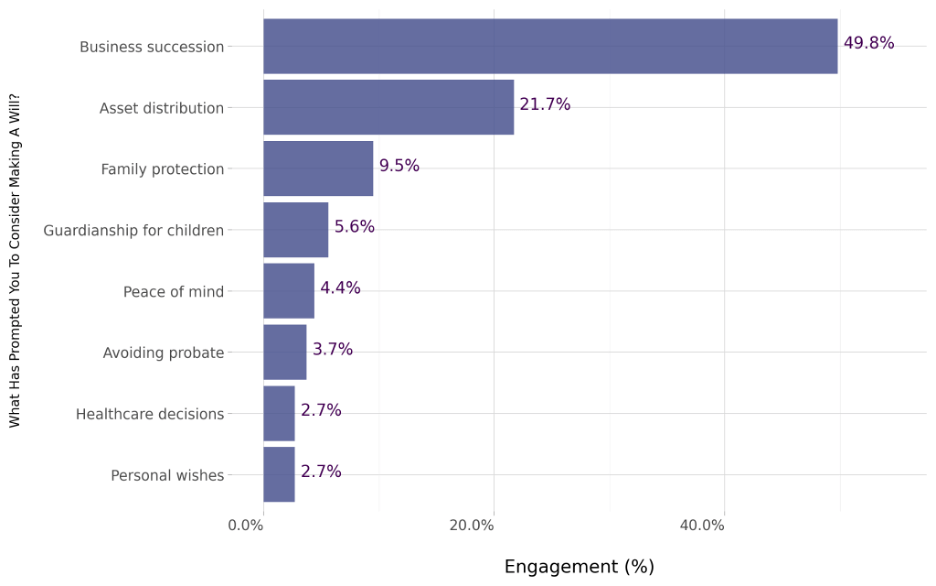

What Has Prompted You To Consider Making A Will?

49.8% made a will to ensure business succession

Interestingly, of our audience, business succession tops the list as the catalyst for drawing up a will. Here’s what else our findings show:

Despite the Azets Barometer January 2024 survey finding that fewer than 1 in 10 UK businesses have a succession plan integrated into their strategy, the largest portion of our audience (49.8%) cited business succession as the prompt for making a will. However, the Azets survey did find that despite the low number that have taken action, 30% of companies recognised the importance of succession planning.

So, it’s positive to see that, in our case, a large number of people have prioritised succession planning by incorporating it into their decision to create a will. This contrast highlights a growing awareness among individuals about the importance of securing their business's future, even if many companies have yet to formalise such plans within their strategies.

Asset distribution (21.7%) had the second-highest engagement level, followed by family protection (9.5%) and guardianship for children (5.6%). These all correlate with ensuring that final wishes for property, family, and dependents are followed rather than leaving them up to the legal system.

Peace of mind was also a driving factor, at 4.4%, while avoiding probate registered 3.7%. By avoiding probate, testators can save those left behind from enduring a potentially time-consuming, costly, and invasive process, which should certainly be a motivator for those with large or complex estates. Interestingly, healthcare decisions and personal wishes garnered minimal engagement, both with 2.7%, revealing that our audience is more concerned with what and who they leave behind than themselves.

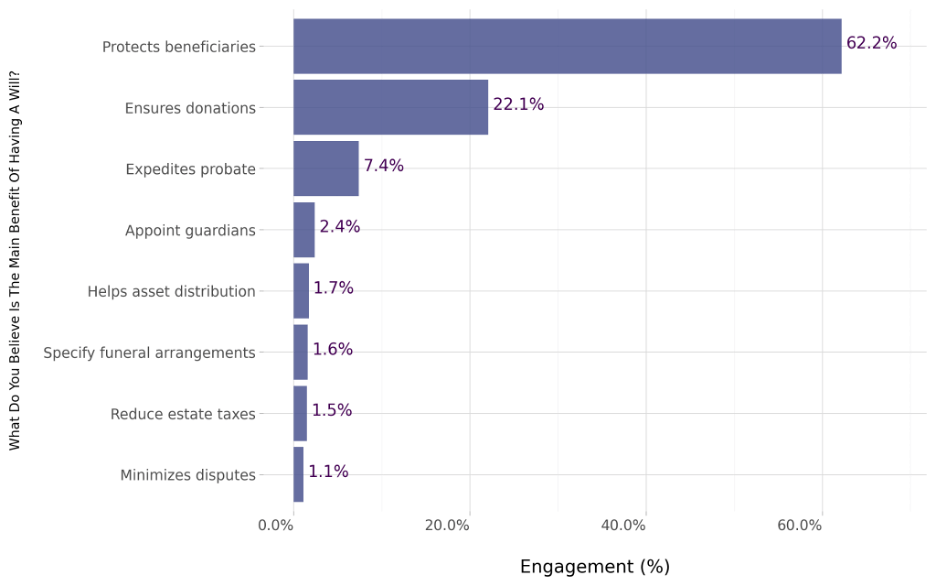

What Do You Believe Is The Main Benefit Of Having A Will?

62.2% believe a wills main benefit is protecting beneficiaries

Having a will has many benefits, and the graph below outlines which ones our audience believes are the biggest:

62.2% of our profiled audience agree that the main benefit of having a will is protecting beneficiaries. This aligns closely with research showing that 71% of those who have a will have done so to make life easier for loved ones, while 49% wanted to protect their family’s interests after their death.

22.1% said that a will ensures donations, which has become a priority for many. In the UK, more than one in five donors say they have included a charitable gift in their will, which is an increase of nearly 10% in about a decade. In third place with 7.4% engagement, our audience believes that the biggest benefit is speeding up probate, once again highlighting concerns about this process.

Thereafter, engagement levels dropped dramatically, with 2.4% for appointing guardians, just 1.7% for helping asset distribution, 1.6% for specifying funeral arrangements, 1.5% for reducing estate taxes and 1.1% for minimising disputes. With the recent changes to inheritance tax, especially for farmers, it will be interesting to see whether reducing estate taxes becomes more of a considered benefit in the future.

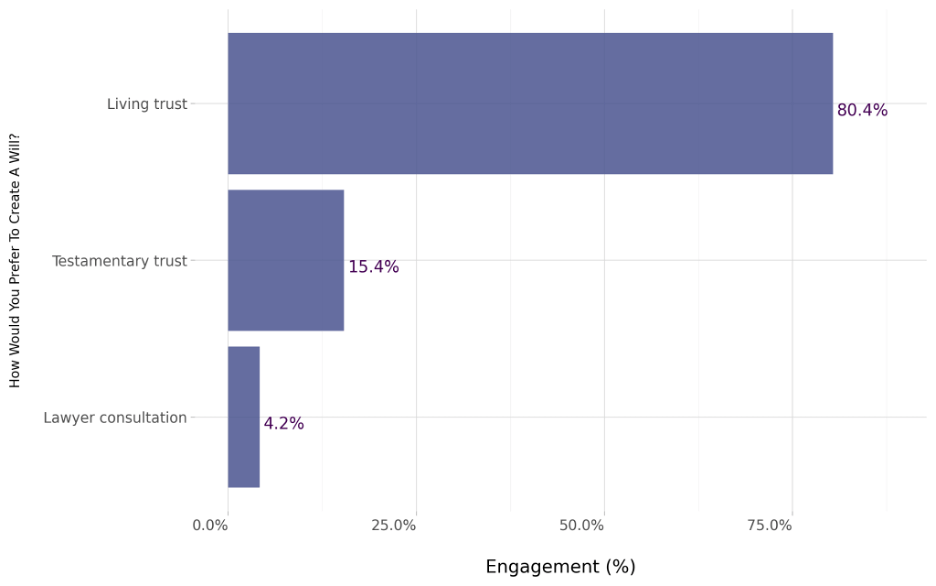

How Would You Prefer To Create A Will?

Over 80% would prefer to create a living trust

The vast majority of our audience prefers a living will over a testamentary trust, while the lowest percentage prefers consulting with a lawyer. We’ve unpacked these statistics below:

With an overwhelming 80.4% majority preferring to create a will as a living trust (set up during their lifetime to provide explicit directions for the distribution of assets after death), it’s evident that this type of trust is highly favoured for its ability to bypass probate, maintain privacy, and ensure a smoother transfer of assets to beneficiaries.

In contrast, just 15.4% would prefer a testamentary trust (where assets and property are transferred into the trust to be managed and distributed according to their wishes).

Surprisingly, only 4.2% of the audience would prefer to create a will during a consultation with a lawyer. This may be related to cost, which is a major concern for many. However, it would provide peace of mind for anyone concerned about the security of their beneficiaries.

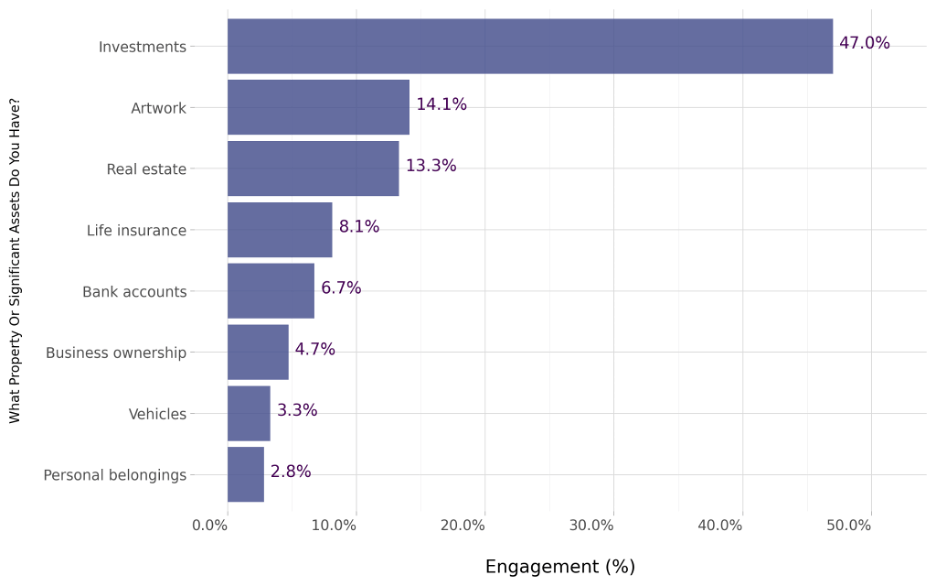

What Property Or Significant Assets Do You Have?

Nearly 50% name investments as most significant assets

From investments to personal belongings, our findings illustrate what assets our audience’s own:

Nearly half (47%) list investments as their most significant assets. Far behind this at 14% is artwork, followed by 13.3% with real estate. Life insurance only garners 8.1% engagement, which ties in with the fact that 51% of adults under 40 years of age do not have this cover.

Bank accounts register even lower engagement at 6.7%, followed by business ownership at 4.7%, which is surprising considering that we found that business succession was the biggest motivator for drawing up a will. Vehicles came in even lower at 3.3%, followed by personal possessions with 2.8%, making them the lowest on the list.

Demographics

Our audience profiling also included assessing the demographics of our 118,578 sample group. Here’s what we discovered:

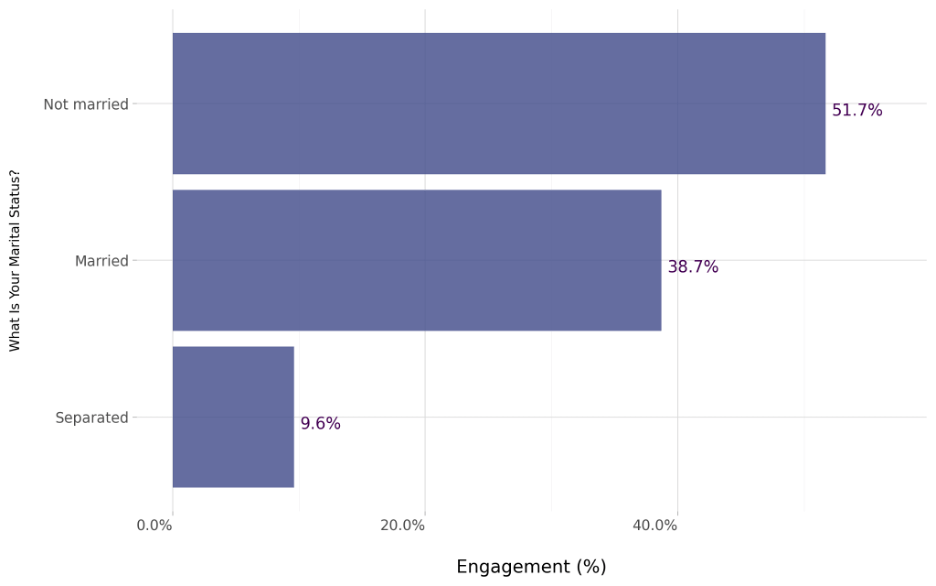

What Is Your Marital Status?

Over 50% of our audience is unmarried

Relationship status can play a major role in how a will is written and what is included. The below graph breaks down the marital status of our profiled audience:

In England and Wales, marriage or civil partnerships remain the most common partnership status. However, the number has decreased in recent years, consistently dropping from 51.2% in 2012 to 49.4% in 2022.

In our audience, the largest % were unmarried at 51.7%, while 38.7% were married, and 9.6% were separated. These findings align very closely with the decrease in partnership status numbers and reflect growing trends across the country.

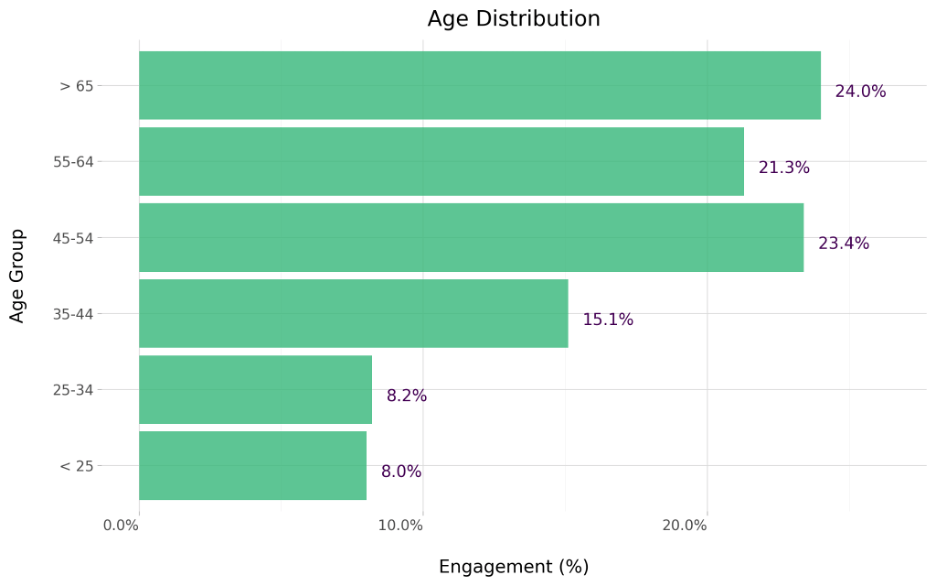

Age

Over 65s have highest engagement levels by just 0.7%

The oldest age group was also the largest of those we profiled by a very slim margin. Here’s what we determined regarding the ages of our audience:

According to the Office for National Statistics, the average life expectancy is 78.6 years for males and 82.6 years for females. It’s understandable that of our profiled group, 68.7% were older than 45. Those 44 and younger saw a decline by a decade, which correlates with findings that younger individuals under 40 tend to consider making a will as irrelevant to their current stage of life.

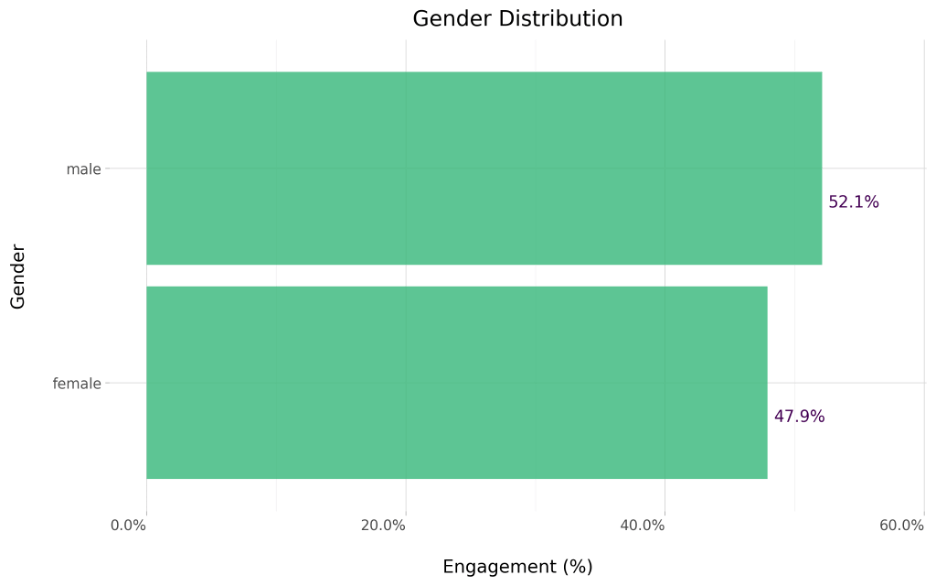

Gender

Men nearly 5% more likely to make wills than women

Find out how engaged men and women were on the topic of wills:

A report from The National Will Register found that 50% of men, compared to 39% of women, were more likely to have a will, and 62% of men, compared to 55% of women, were more likely to discuss their estate with loved ones. Interestingly, our data had a much narrower margin, with 52.1% of the audience being male and 47.9% female. While these figures are engagement levels on the topic rather than those having a will, the balance is far better and indicative that women are at least talking about the legalities of death.

Overall, these statistics revealed a concerning lack of will ownership, with only 4.1% of the audience having a will and nearly half citing fear of death as the main barrier. What is encouraging, however, is that over half the audience plans to create a will, showing a growing awareness of the need for estate planning, particularly for business succession and asset protection.

About the Data

The data used was sourced from an independent sample of 118,578 people from X, Quora, Reddit, TikTok and Threads. The responses are collected within a 65% confidence interval and 6% margin of error and engagement estimates how many people in the location are participating. Demographics are determined using many features, including name, location and self-disclosed description. Privacy is preserved using k-anonymity and differential privacy. Results are based on what people describe online — questions were not posed to the people in the sample.