As many as a third of homes sold in the UK annually are bought by first-time buyers, but over the years, the way these purchases have been made, buyer demographics, preferences, and challenges have changed considerably. As the demand for first homes has risen 20% year-on-year, it’s interesting to see how the market has responded to this growing segment's evolving needs and circumstances.

To better understand the first-time buyers market, we leveraged AI-driven audience profiling to synthesise insights from opinions expressed online to a high statistical confidence level. Our data covered a 12-month range, ending 9 December 2024, and had a sample size audience of 123,653. Here’s what we learnt about first-time homebuyers in the UK:

Index

- 44% first-time buyers battled with timing when purchasing their homes

- 36.4% first-time buyers plan on making insulation improvements

- Property condition top priority for 36.7% first-time buyers

- Nearly 30% of first-time homebuyers surprised by legal fees

- 66.7% agree financial advice would have made buying a first home easier

- Personal goals the motivation for over 60% of first-time homebuyers

- Over 50% of first-time buyers are employed part-time

- Only 4.1% of first-time homebuyers are married

- Just 1% of first-time homebuyers want a leasehold

- London the most desirable property location for 35.5% first-time buyers

- Just under 40% first-time buyers have a co-buyer

- Modern kitchens a priority for 52.4% first-time buyers

- 31.6% first-time homebuyers want a Help to Buy mortgage

- 33.3% first-time buyers are advised by real estate agents

- Over 65s make up 22.2% of first-time homebuyers in the UK

- Women account for more than 10% of first-time homebuyers than men

- About the data

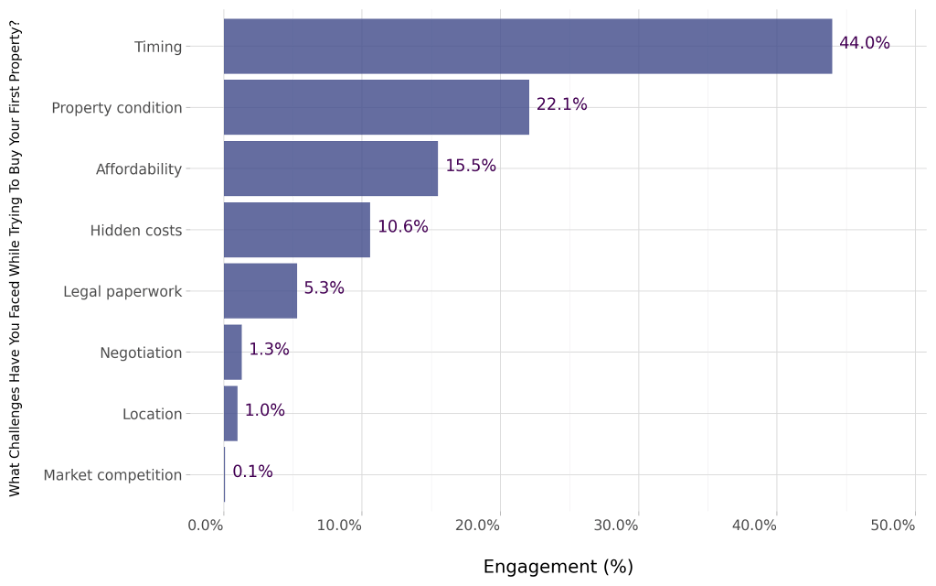

What Challenges Have You Faced While Trying To Buy Your First Property?

44% first-time buyers battled with timing when purchasing their homes

From timing to affordability and market competition, our data reveals what UK first-time homebuyers found to be the biggest challenges:

For nearly half of our profiled audience (44%), timing was the biggest challenge when purchasing a first home, followed by property condition at 22.1%

Affordability was only a challenge for 15.5%, which is interesting when you consider that with the combination of stagnant wages and the cost-of-living crisis, it’s now harder for buyers to save a deposit due to a lack of disposable income. However, in a recent Uswitch survey, 53% of renters cited affordability as the main reason they’re not planning on buying a home in the next five years. This ties in with timing, as it delays the dream of homeownership for many and aligns with the highest engagement levels in our data.

For 10.6% hidden costs were the biggest challenge, while legal paperwork was cited by 5.3%, negotiation 1.3%, and location 1%. Despite a survey from Market Financial Solutions that found 63% of respondents felt that the UK’s property market is too competitive, our audience only racked up engagement levels of 0.1%, proving that the other challenges were far more pertinent.

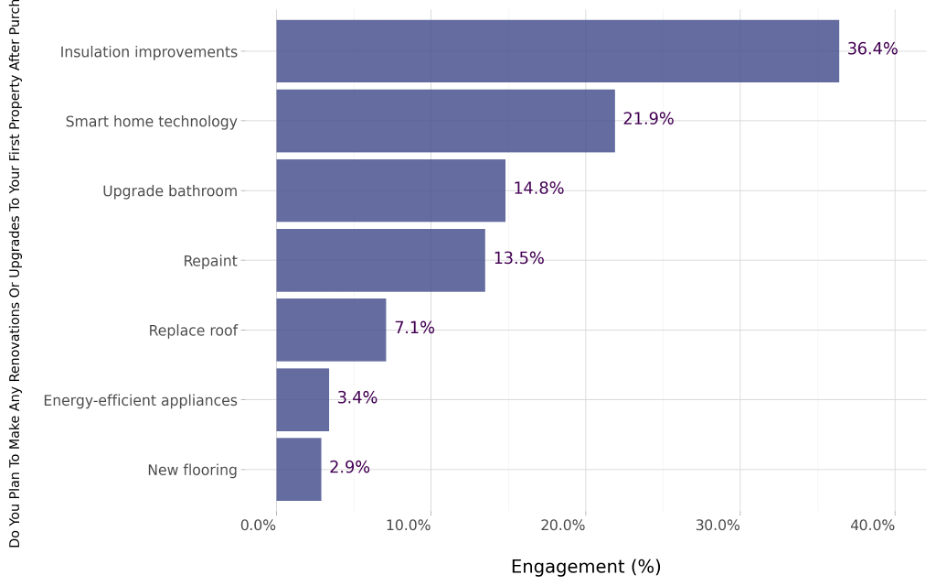

Do You Plan To Make Any Renovations Or Upgrades To Your First Property After Purchase?

36.4% first-time buyers plan on making insulation improvements

Saving on energy costs is spurring on first-time buyers to invest in insulation upgrades and smart technology. Here’s what other improvements buyers will be making:

With the energy crisis in the UK affecting a huge number of households and the price cap rising by 1.2% in 2025, it’s understandable that 36.4% of first-time buyers will be making insulation improvements to their properties.

Integrating smart home technology came in second, with engagement levels of 21.9%. While many may initially think this is a luxury, it ties in with sustainability and being more energy efficient as it can be used to adjust lighting and thermostats remotely. However, only 3.4% will invest in energy-efficient appliances, with replacing roofs (7.1%), repainting (13.5%), and upgrading bathrooms (14.8%) all being higher priorities. The only priority lower than upgrading appliances was installing new flooring, at 2.9%.

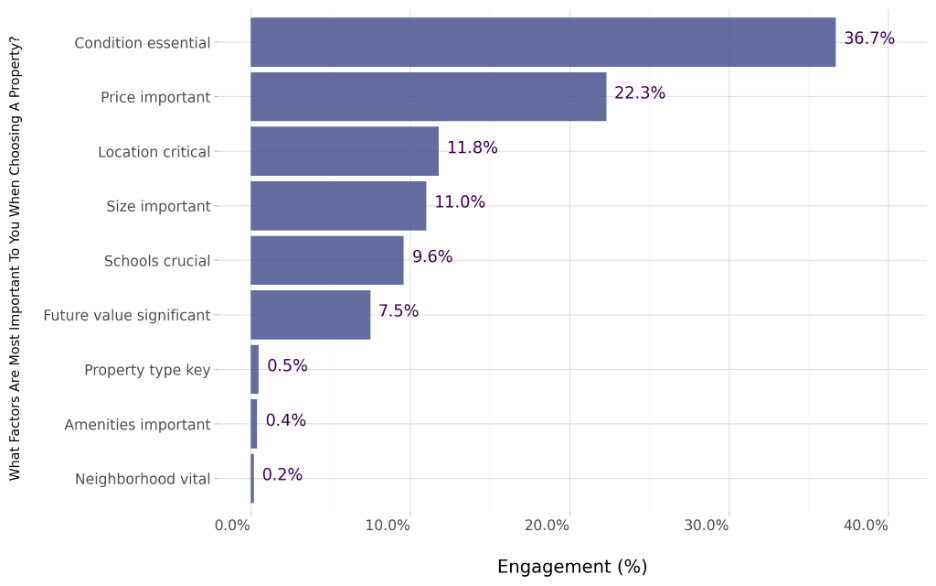

What Factors Are Most Important To You When Choosing A Property?

Property condition top priority for 36.7% first-time buyers

First-time buyers have plenty to consider when making their first purchase. In the graph below, the most common priorities are revealed:

For 36.7% of our audience, the condition of the property was the most important factor, followed by the price at 22.3%. At almost half of the level of engagement recorded for price was location being a critical factor at 11.8%, followed by size being important (11%) and schools being crucial (9.6%). For 7.5%, future value was a significant factor, while property type was only key for 0.5%. Amenities were only important for 0.4%, and the neighbourhood was only vital for 0.2%.

These priorities align with the soaring cost of property in England. The average price of a flat in 2017 was £290,557—almost five times the 1996 average of £59,016. Similarly, semi-detached houses rose to £245,272, a 3.7-fold increase since 1996. If flats continue their historical average annual price growth of 8%, they could reach an astonishing £778,757.62 by 2038, emphasising the increasing importance of future value in property decisions.

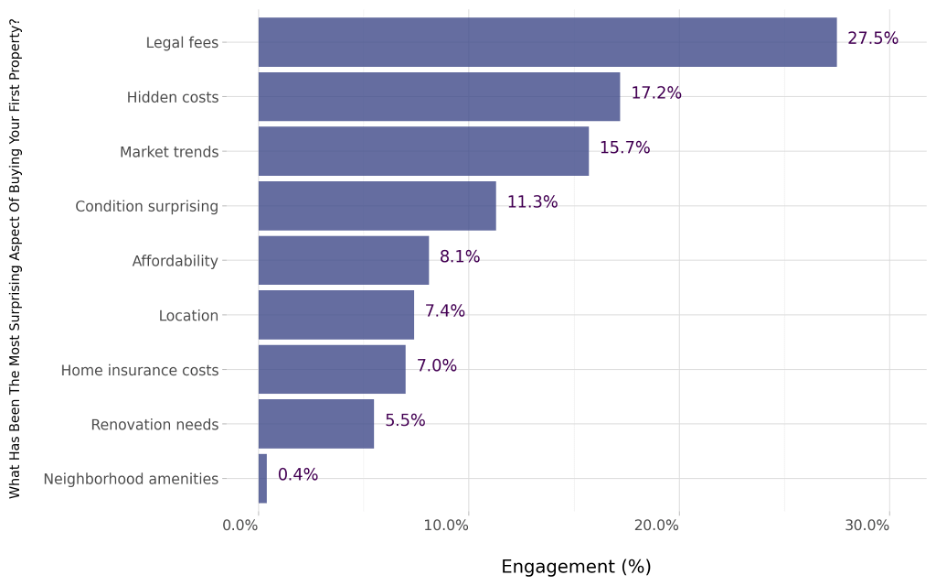

What Has Been The Most Surprising Aspect Of Buying Your First Property?

Nearly 30% of first-time homebuyers surprised by legal fees

Purchasing a home comes with numerous costs, and these are what our audience found the most unexpected:

From 2023 to 2024, the average cost of conveyancing rose by 18.7% to £1,567. This quick, marked increase could be why 27.5% of our audience said that legal fees were the most unexpected cost of purchasing their first home. The second largest number (17.2%) said that hidden costs were the most unexpected, again highlighting the expenses accompanying purchasing a home.

15.7% were surprised by market trends, 8.1% by affordability, and 7% by home insurance costs, which ties in with the increase in legal fees in the last year, rising inflation rates, and the housing crisis sweeping the UK.

For 11.3%, the condition of properties was the most surprising factor, while location was unexpected for 7.4%, renovation needs (5.5%), and neighbourhood amenities (0.4%) garnered low engagement levels, proving they were not widely anticipated as key considerations when evaluating properties.

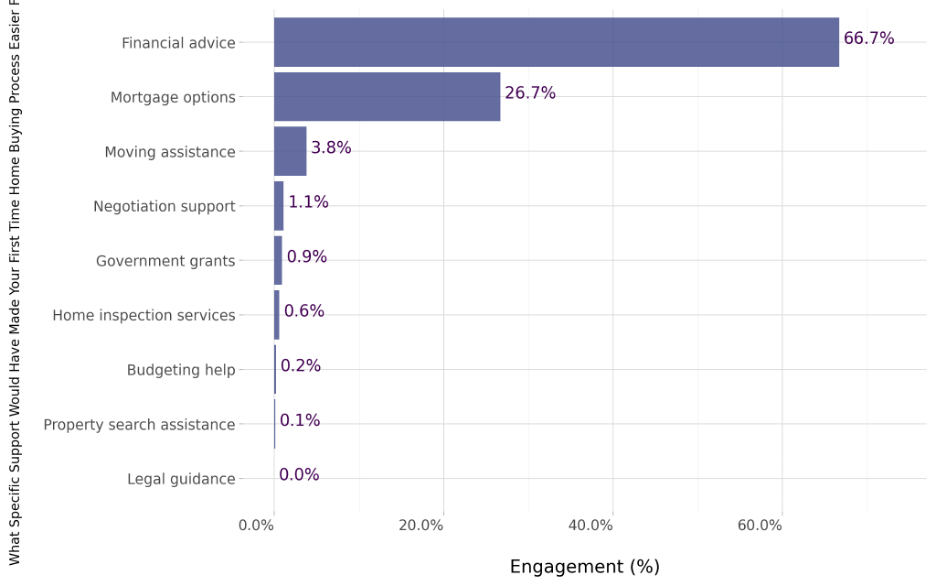

What Specific Support Would Have Made Your First Time Home Buying Process Easier For You?

66.7% agree financial advice would have made buying a first home easier

Based on our data, it’s clear that first-time buyers lack support in specific areas:

Well over half (66.7%) of our audience agreed that having financial advice would have made the first-time home-buying process easier. This aligns with a Halifax report that found that 51% of first-time buyers didn’t know what they could afford, and 30% didn't understand the process. This also correlates with the 26.7% who would have benefitted from mortgage option support.

Thereafter, engagement levels dropped dramatically, with just 3.8% citing moving assistance as a specific support that would have made the process easier, followed by negotiation support at 1.1%. Garnering below 1% engagement was having government grants, home inspection services, budgeting help, property search assistance, and legal guidance, highlighting just how much of a demand there is for financial guidance.

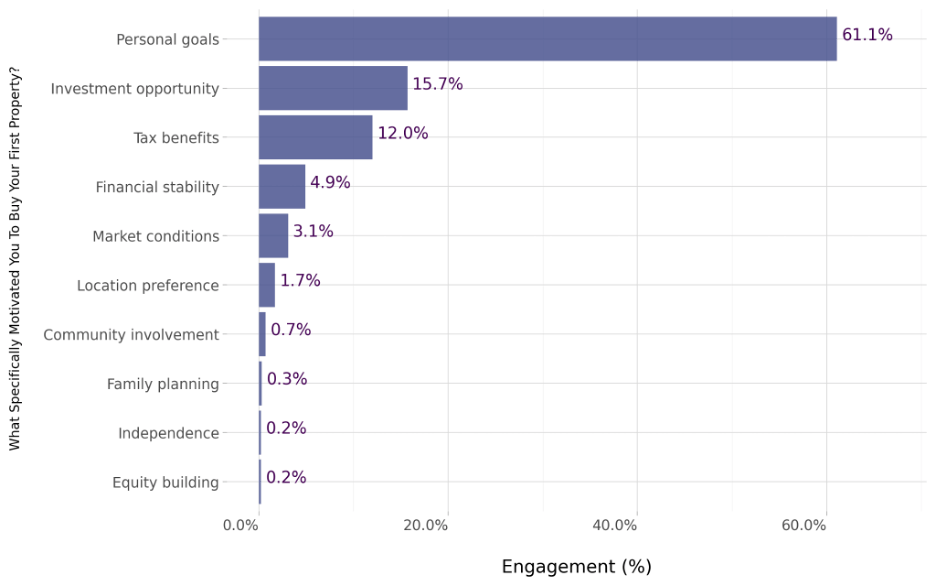

What Specifically Motivated You To Buy Your First Property?

Personal goals the motivation for over 60% of first-time homebuyers

Our audience scores the highest for ambition being a motivating factor behind buying their first homes. We took a closer look at all the most common motivating factors:

With 61.1% citing personal goals as their main motivation for purchasing their first home, it's clear that homeownership is still hugely desirable across the UK. Following the highest engagement levels were those motivated by investment opportunities (15.7%), those who did it for the tax benefits (12%) and 4.9% for financial stability. Considering the average rent in England increased by 8.8% from 2023 to £1,348 in October 2024, these are all in line with current sentiments.

On the lower end of the list were those motivated by market conditions (3.1%), location preference (1.7%), and community involvement (0.7%). Family planning (0. %), independence (0.2%), and equity building (also 0.2%) barely registered as motivating factors, revealing that these were not common goals among first-time buyers.

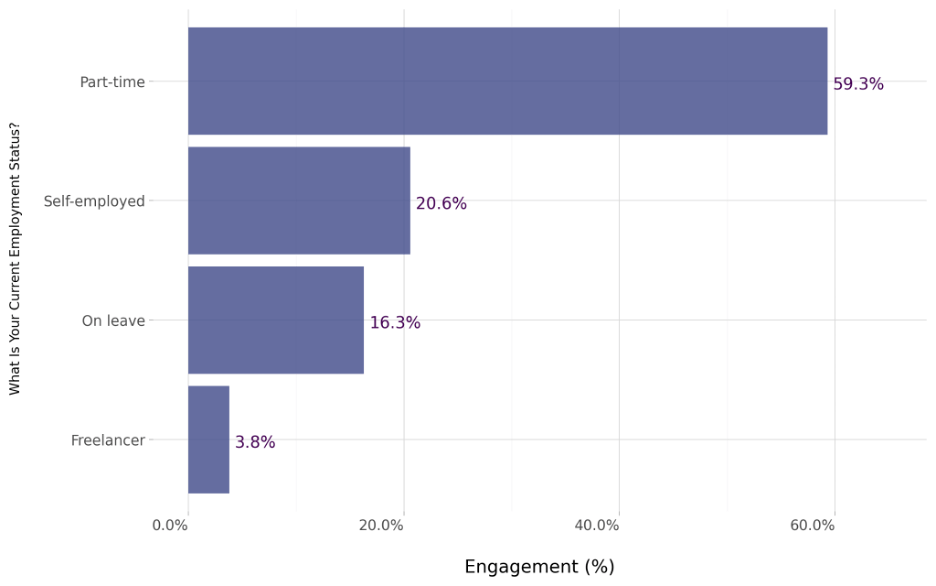

What Is Your Current Employment Status?

Over 50% of first-time buyers are employed part-time

Our data assessed the employment status of the 123,653 sample group, and this is what we found:

59.3% of our audience is employed part-time, and 20.6% are self-employed. In contrast, nearly half of that are on leave (16.3%), while just 3.8% are freelancers. Initially, the large number of part-time workers may seem unusual, but record numbers of people in their 50s and older now fall into this category, which correlates largely with the age demographics we recorded amongst our audience.

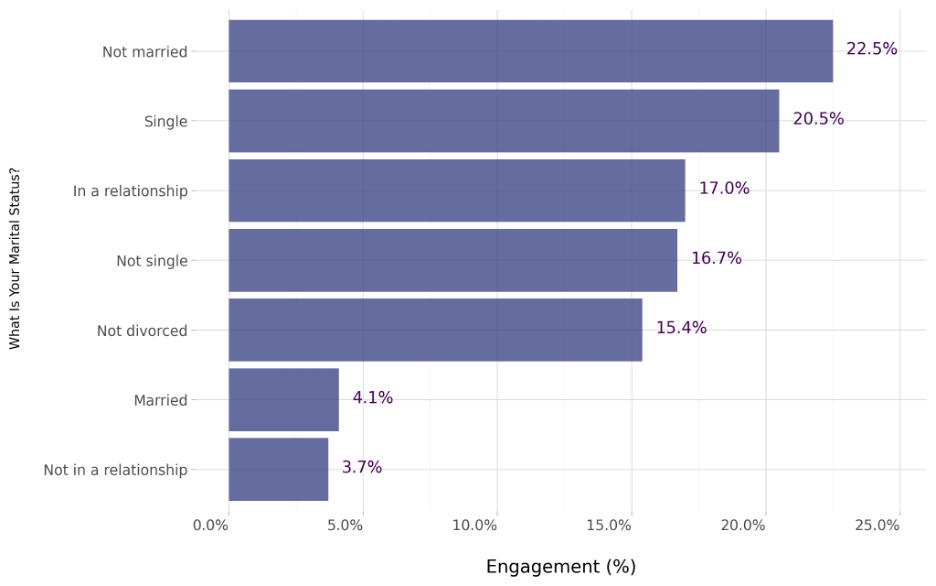

What Is Your Marital Status?

Only 4.1% of first-time homebuyers are married

Not married and single homebuyers top our list of first-time purchasers. The graph below outlines the relationship status of our full audience:

With marriages declining 20.8% between 1992 and 2022, the fact that 22.5% of first-time buyers were not married does not come as a huge shock. Add to this the 20.5% who were single and 3.7% not in a relationship, and it proves again that marriage is no longer a criteria for making large purchases - especially as only 4.1% of our audience have tied the knot.

Those in a relationship make up 17% of first-time homebuyers, not single 16.7% or not divorced (15.4%), which largely correlates with findings that couples with no dependent children account for two in five of the total purchases in 2022-2023.

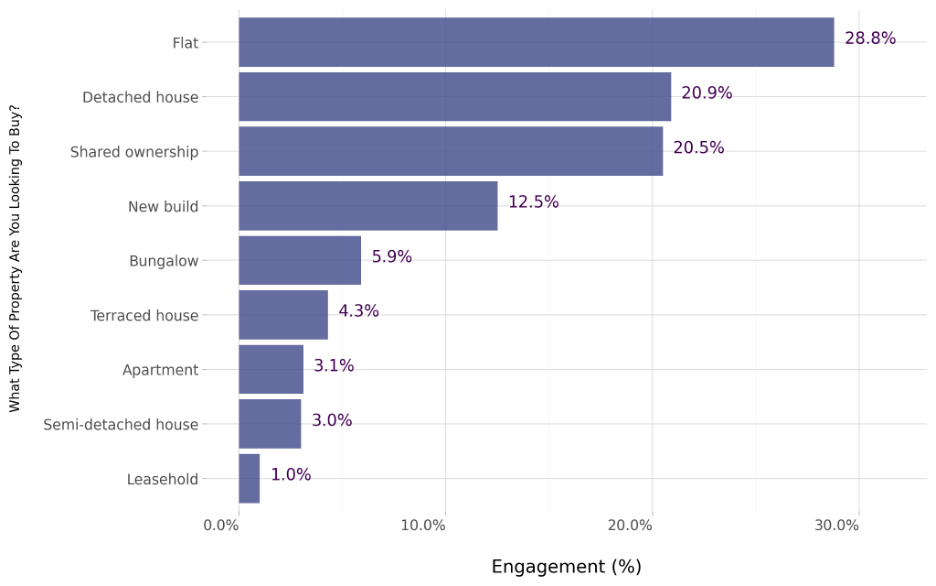

What Type Of Property Are You Looking To Buy?

Just 1% of first-time homebuyers want a leasehold

While leasehold is in the least demand, flats are in the highest. These are all the property types most and least desired by first-time buyers:

Despite the cost of flats soaring more than any other property type, 28.8% of our audience is looking to buy this type of property. Detached houses are the second most popular choice at 20.9%, while new builds are a preference for 12.5%, bungalows for 5.9%, terraced houses for 4.3% and apartments for 3.1%, followed closely by semi-detached houses at 3%.

However, where the preferences are most notable are the 20.5% who are looking for shared ownership. This government scheme has grown in popularity as it gives first-time buyers the opportunity to purchase a share in a new-build or resale property. These properties are usually leasehold, which makes the engagement rates of just 1% of those looking for a leasehold somewhat contradictory compared to those who want shared ownership. This may be due to the difference in how the property is acquired, as opting for shared ownership is far cheaper than buying a leasehold outright.

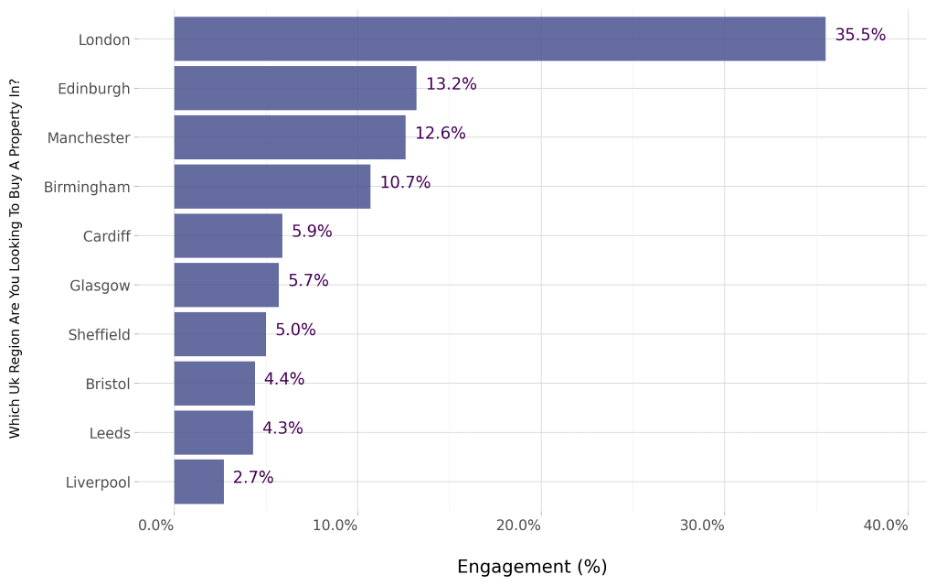

Which UK Region Are You Looking To Buy A Property In?

London the most desirable property location for 35.5% first-time buyers

In the graph below, we unpack which UK regions first-time buyers most want to purchase their homes in:

Despite being the most expensive city for first-time buyers, London tops the list, with 35.5% of our audience looking to buy property here. Well below and in second place is Edinburgh, which also has a far higher average cost of a house in the UK. Manchester comes in just behind at 12.6%, before Birmingham at 10.7%. Cardiff is the most desirable location in Wales at 2.9%, before Scotland’s Glasgow at 5.7%.

Thereafter, Sheffield, Bristol, Leeds and Liverpool take buyers back to England, racking up lower engagement levels that bottom out at 2.7%. Overall, this list shows that while London is the number one preference, there are plenty of other desirable regions across the UK that homebuyers are considering for their first purchases.

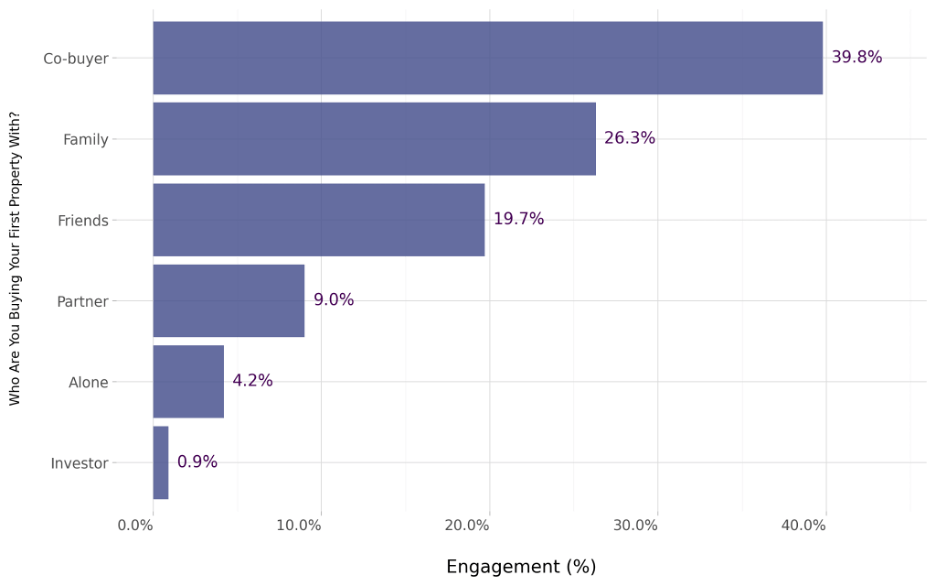

Who Are You Buying Your First Property With?

Just under 40% first-time buyers have a co-buyer

Buying a home alone is not a common option for first-time buyers in the UK. Here’s who buyers are purchasing homes with.

Despite our earlier reported high engagement levels for those who are not married, not in a relationship, and single, buying a first home alone is only an option for 4.2% of our audience. In contrast, 39.8% have a co-buyer, 26.3% family, 19.7% friends, and 9% partners, while just 0.9% have an investor.

The 19.7% who are buying with friends highlight the increase in so-called “mortgage mates”, a trend that is fast-growing traction, with Lloyds reporting that 46% of first-time buyers are now considering this option.

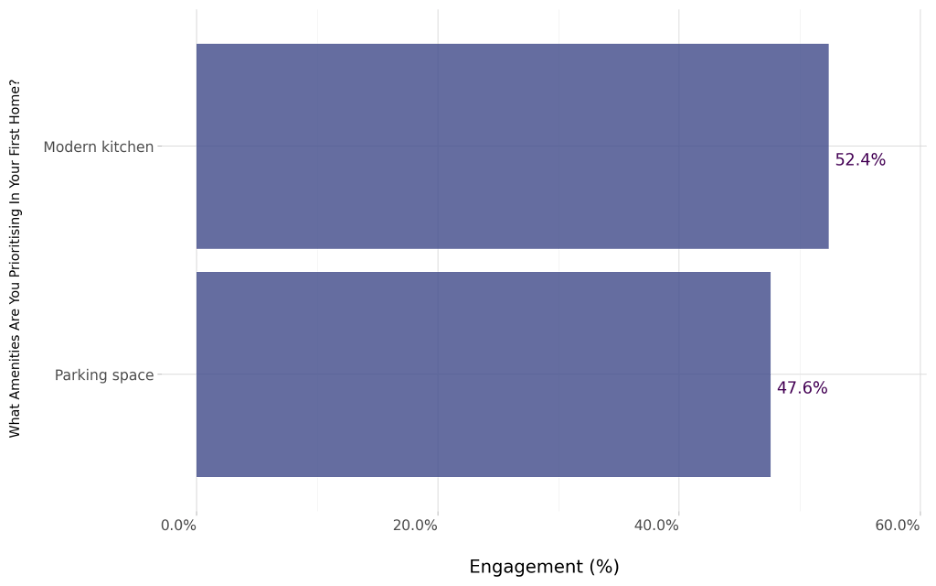

What Amenities Are You Prioritising In Your First Home?

Modern kitchens a priority for 52.4% first-time buyers

The gap between wanting a modern kitchen and a parking bay is marginal. We delve deeper into what’s behind the data in this graph:

52.4% of our audience prioritises a modern kitchen in their home, and this may be due to the fact that having this amenity can increase a property’s value by between 5 and 12%. For the 47.6% who prioritise a parking space, this amenity also adds value, which increases depending on the location of the property. On average, a property with parking is not only convenient, but it can also add almost £12,000 to the price compared to a similar property without parking.

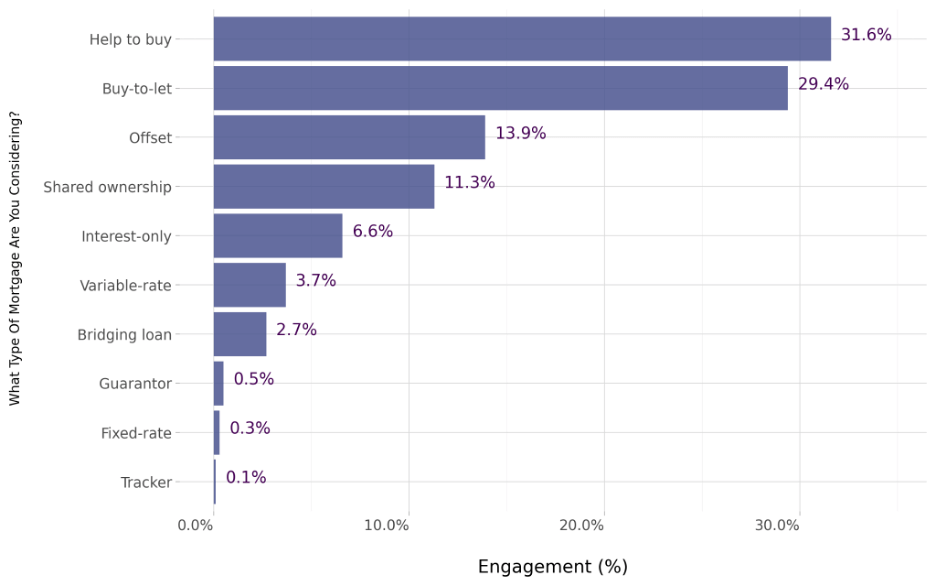

What Type Of Mortgage Are You Considering?

31.6% first-time homebuyers want a Help to Buy mortgage

Explore the type of mortgages UK first-time homebuyers want, as outlined by the graph below:

Although the UK Help to Buy scheme ended in March 2023, it’s clear that this is still the type of mortgage that our audience wants, with 31.6% buyers saying so. The 5% deposit was hugely appealing as it lowered barriers to entry, which is also what the buy to let option does. This is likely why it’s the second most considered mortgage type at 29.4%, followed by offset at 11.3% which offers more flexibility.

Shared ownership once again scores relatively highly at 11.3% before engagement levels drop to 6.6% with those seeking an interest-only mortgage. Variable rate (3.7%) and bridging loan (2.7%) were not highly considered, but they still topped guarantor (0.5%), fixed rate (0.3%), and tracker mortgages (0.1%), which proved to be the least popular. This highlights a clear preference for more traditional mortgage options, with niche mortgage products attracting minimal interest among respondents.

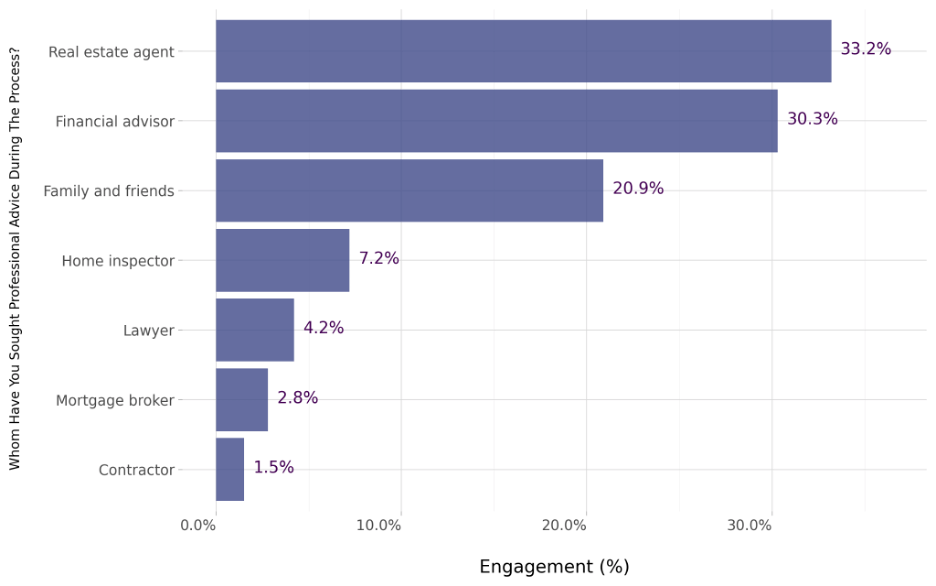

Whom Have You Sought Professional Advice From During The Process?

33.3% first-time buyers are advised by real estate agents

Professional advice is invaluable when making a large purchase of any kind. These are who first-time buyers got their advice from:

With 66.7% of our audience agreeing that financial advice would have made buying a first home easier, it’s interesting to note that 30.3% did, in fact, seek advice from a financial advisor. This was topped only by the 33.2% who sought advice from a real estate agent.

Family and friends were the third most common source of advice at 20.9% before engagement levels dropped down to 7.2% for home inspectors, 4.2% for lawyers, 2.8% for mortgage brokers, and 105% for contractors. The low number of those who sought advice from mortgage brokers is somewhat unexpected, as there are 5,593 mortgage broker businesses in the UK, making them very readily accessible resources.

Demographics

To gain greater insights into our sample group, we also analysed the demographics of our 123,653-strong audience.

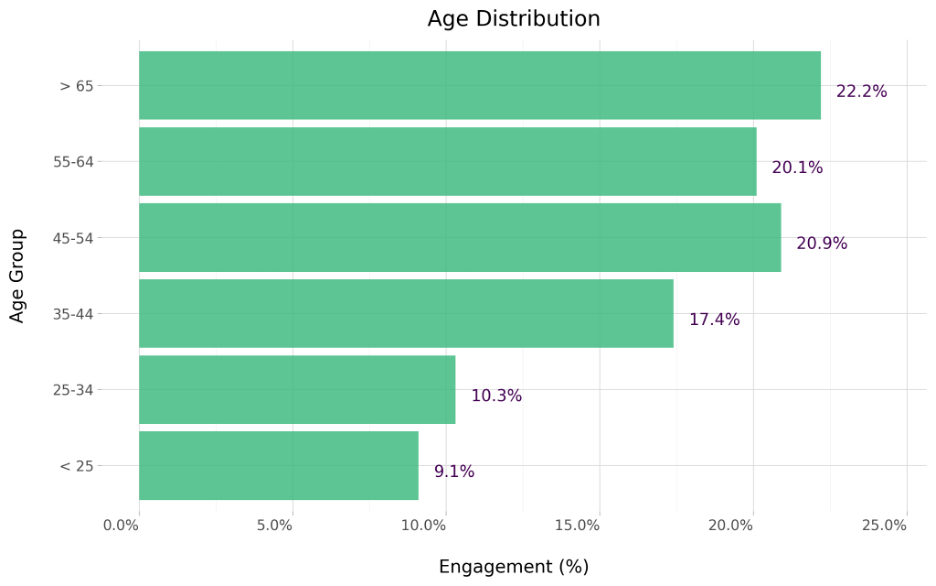

Age

Over 65s make up 22.2% of first-time homebuyers in the UK

From over 65 to under 25, the graph below illustrates the ages of our audience:

Those over the age of 65 made up the biggest portion of our audience at 22.2%, followed by 55-64 with 20.1%, and 45-54 at 20.9%. This means that 63.2% of first-time buyers were all over the age of 45. This aligns with the UK government recording an increase in the proportion of first-time buyers aged 45 or older from 5% to 13% in 2023.

However, the UK government statistics differ somewhat from our audience engagement. They found that in 2022-2023, most first-time buyers were aged between 25 and 34. In contrast, our audience had the second-lowest engagement levels between 25 and 24 (10.3%) before increasing to 17.4% for those aged 35-44.

Unsurprisingly, those under 25 had the lowest engagement levels at 9.1%. Yet, this is still a notable number, considering it now takes 12 years for a typical UK first-time buyer to save enough for a deposit on a house.

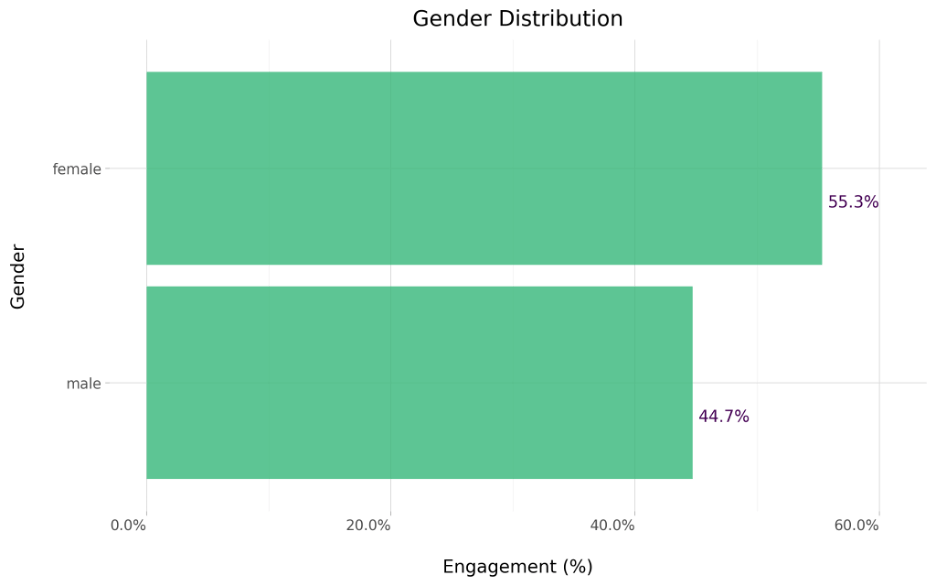

Gender

Women account for more than 10% of first-time homebuyers than men

Our data highlights the gender gap between female and male first-time homebuyers in the UK:

Although reports show that the gender housing affordability gap has widened, and 47% of men compared to 39% of women expected to buy their own homes, our audience put women ahead of men by 10.6%. Female first-time buyers comprised 55.3% of our audience compared to 44.7% of men. This shows a positive upward trend in women taking the lead in homeownership despite broader affordability challenges, signalling their growing financial independence and determination to enter the property market.

Overall, these statistics paint a clear picture of first-time homebuyers in the UK and the challenges they face. One point that stands out is the need for support when navigating the process, highlighting the importance of working with experienced and qualified conveyancers during property transactions. This will ensure the purchase process goes smoothly and a vast majority of common challenges are mitigated.

By addressing these challenges with the right guidance and resources, first-time buyers can approach their homeownership journey with confidence and greater peace of mind.

About the Data

Our data was sourced from an independent sample of 123,653 first-time buyers from X, Quora, Reddit, TikTok and Threads. The responses are collected within a 95% confidence interval and 4% margin of error and engagement estimates how many people in the location are participating. Demographics are determined using many features, including name, location and self-disclosed description. Privacy is preserved using k-anonymity and differential privacy. All the results are based on what people describe online — questions were not posed to the people in the sample.