Disputes are almost inevitable in the business environment, whether they're over contracts, intellectual property, or employment matters. However, over the years, the nature of disputes and the way they’re dealt with have changed. To obtain better insights into the current state of these disagreements, we leveraged AI-driven audience profiling to synthesise insights from opinions expressed online to a high statistical confidence level.

Our data assessed 25,708 C-suite executives in the UK for 12 months ending January 25, 2025. It provided an excellent overview of how disputes are being dealt with, current sentiments toward disputes, and the myriad of trends that impact these disagreements. Based on our data, we determined the following:

Index

- 76.1% of C-suite executives most commonly encounter shareholder disputes

- Litigation the most common method, with 45.8% of C-suite executives having used it in the last few years

- 57.2% of C-suite executives prefer mediation as a first dispute resolution method

- 96.4% of C-suite executives said mediator’s expertise was the factor that most influenced their choice of dispute resolution method

- 50% of UK C-suite executives rely on internal legal expertise

- 29% of the audience say Brexit led to more complicated legal frameworks in cross-border or EU-related disputes

- 80.6% of C-suite executives want to see improvements in mediator expertise

- 50% of the audience’s businesses operated in the transportation industry

- Commercial Dispute Trends

- Expansion of Class Actions

- Increased Use of Alternative Dispute Resolution (ADR)

- Growth in Litigation Funding

- Impact of Geopolitical Tensions

- Technological Advancements Influencing Disputes

- Ratification of the Hague Judgements Convention

- Emergence of ‘Mega Trials’

- 42.6% of C-suite executives are 65 years old or older

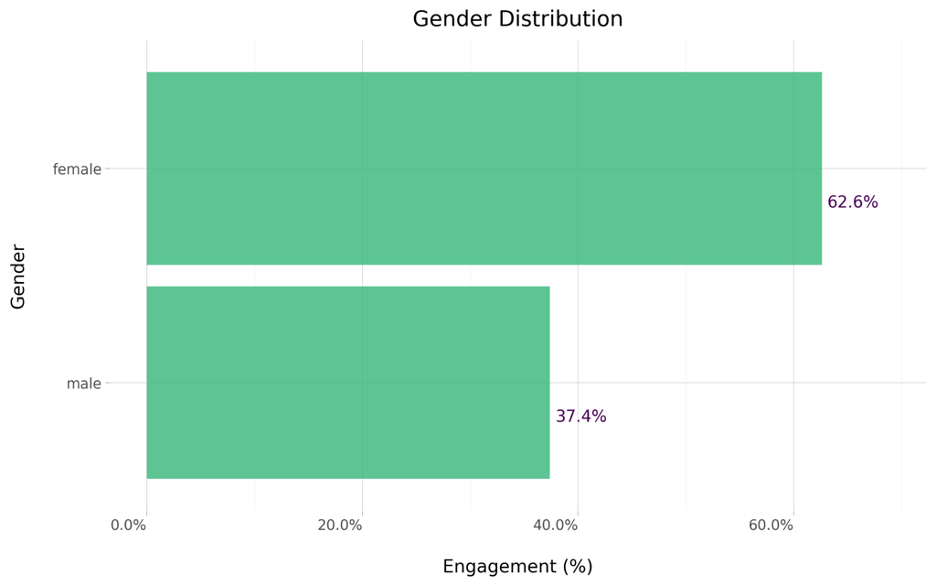

- More than 62% of our audience of C-suite executives is female

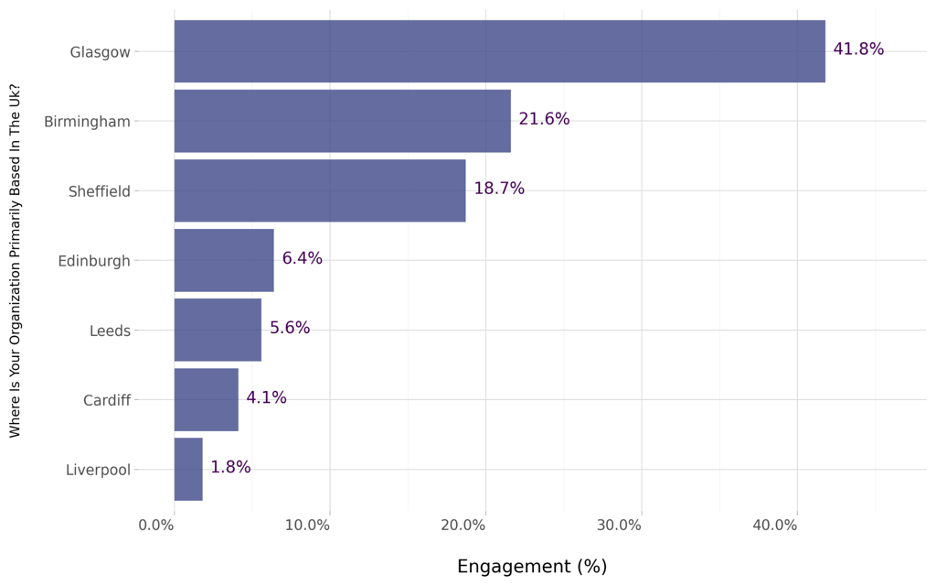

- 41.8% of the audience’s organisations were based in Glasgow, Scotland

- About the Data

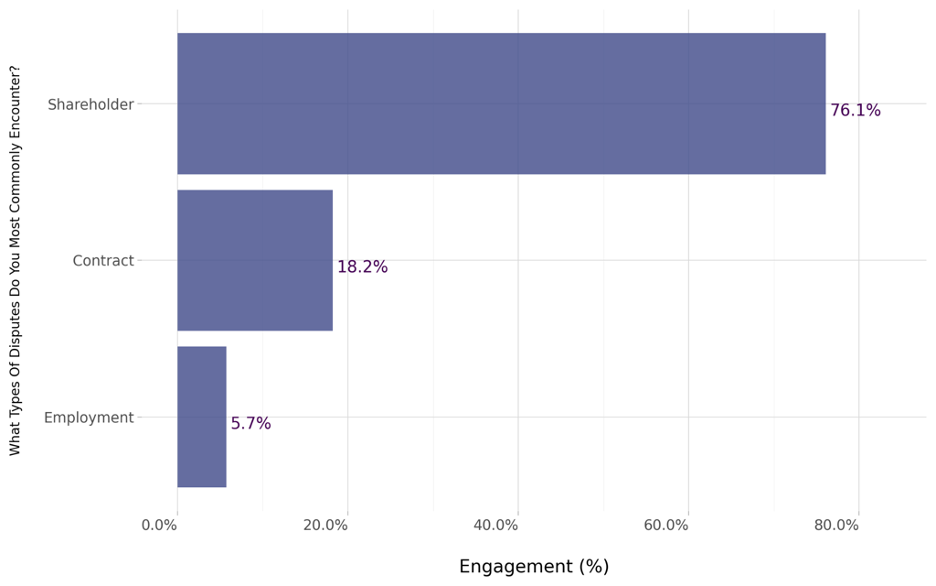

What Types Of Disputes Do You Most Commonly Encounter?

76.1% of C-suite executives most commonly encounter shareholder disputes

The graph below reveals the most common types of disputes encountered by C-suite executives:

According to 76.1% of the audience, shareholder disputes are the dispute types they encounter most commonly. 18.2% of C-suite executives said that they encounter contract disputes, while only 5.7% said they commonly encountered employment disputes.

These findings were somewhat different to research carried out by Gallagher. The global risk management and insurance broker found that 43% of UK businesses had received legal threats since 2019. Of these, 28% had seen litigation cases increase by more than 40% over the last five years. 38% experienced employee disputes, while 35% encountered contractual disputes and 34% had to deal with financial disputes.

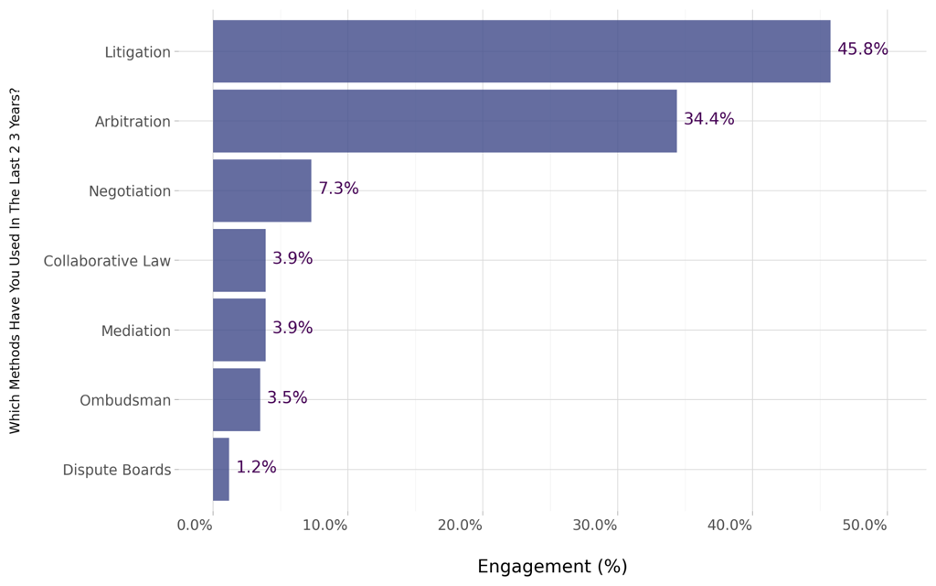

Which Methods Have You Used In The Last Few Years?

Litigation the most common method, with 45.8% of C-suite executives having used it in the last few years

C-suite executives use different methods to resolve or settle commercial disputes. Here’s what they said:

C-suite executives and business owners in the UK use different methods to settle commercial disputes, with the most common of these being litigation (45.8%). With 34.4% of the audience naming arbitration as one of the methods they used in the last two to three years, this was the next most common.

7.3% of C-suite executives said they used negotiation, while 3.9% said they turned to collaborative law. Another 3.9% said they used mediation to settle disputes, while 3.5% approached the ombudsman. Only 1.2% of the audience said they turned to dispute boards.

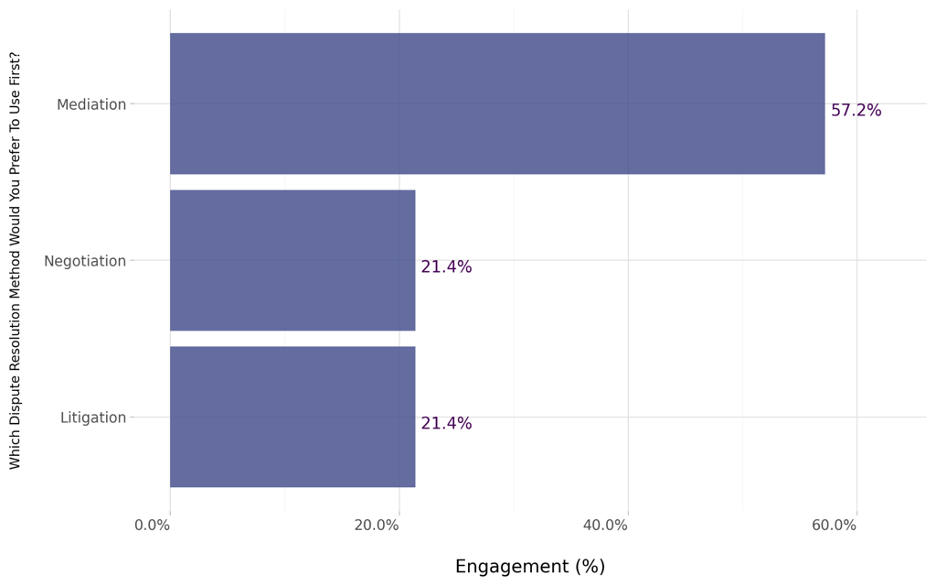

Which Dispute Resolution Method Would You Prefer To Use First?

57.2% of C-suite executives prefer mediation as a first dispute resolution method

The graph below reveals the dispute resolution methods our audience prefers to use first:

As we saw above, almost half of C-suite executives used litigation to settle disputes in the last few years. However, this is not necessarily the method they prefer to use first. We found that 57.2% of the audience prefers to use mediation first. 21.4% of C-suite executives said they would rather use negotiation as a dispute resolution method first, while another 21.4% said they would first use litigation when faced with a dispute.

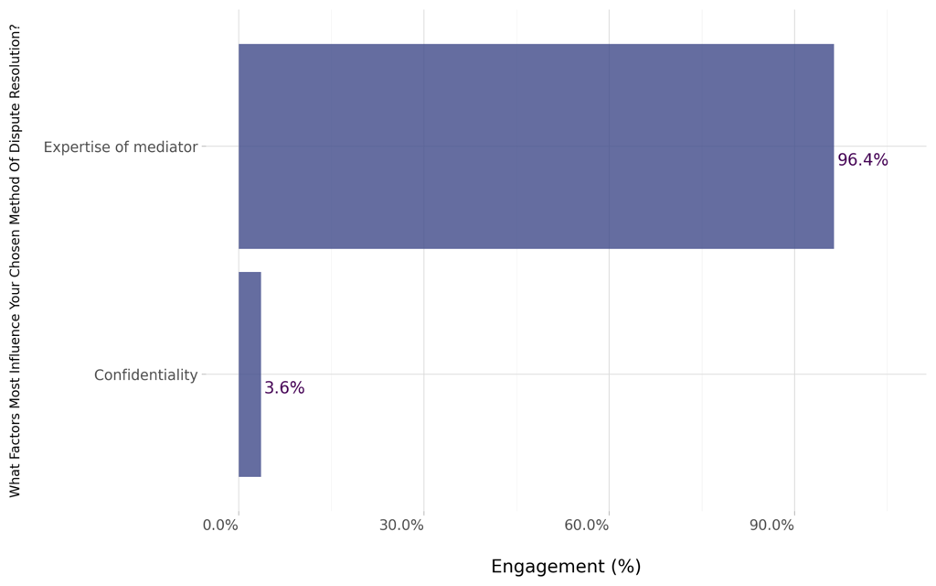

What Factors Most Influence Your Chosen Method Of Dispute Resolution?

96.4% of C-suite executives said mediator’s expertise was the factor that most influenced their choice of dispute resolution method

Different factors influence the methods of dispute resolution chosen by our audience. Here’s what our data reveals:

Various factors can influence the resolution methods that C-suite executives choose when dealing with disputes, with some factors exerting more influence than others. For the overwhelming majority of the audience (96.4%), the expertise of the mediator was the factor that most influenced their chosen method of dispute resolution. Only 3.6% said that confidentiality was the most influential factor when it came to their chosen dispute resolution method.

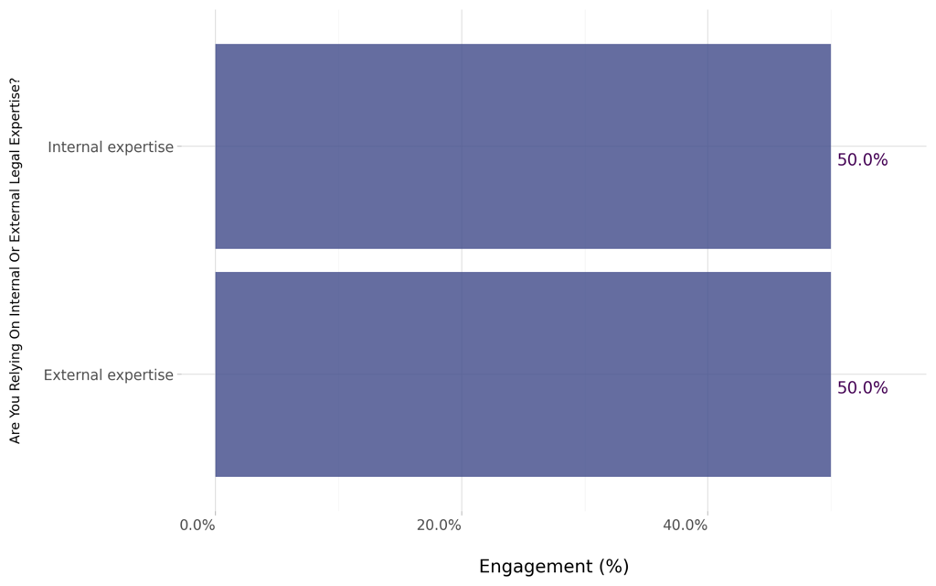

Are You Relying On Internal Or External Legal Expertise?

50% of UK C-suite executives rely on internal legal expertise

The UK’s C-suite executives have an appreciation of both internal and external legal expertise, as you can see from the graph below:

Settling disputes effectively is impossible without legal expertise from within or outside the company. Half of C-suite executives (50%) said they relied on internal legal expertise, such as that of in-house lawyers. The other 50% said that they turned to external legal expertise when they needed to resolve disputes.

While smaller firms often lack the resources for an in-house legal department, team, or lawyer, a growing number of mid-sized and larger companies in the UK have in-house lawyers. According to the Law Society, there were an estimated 31,000 registered in-house solicitors in the UK in 2022. This was almost triple the number of in-house solicitors in 2002.

Describe The Areas Affected By Brexit On Handling Your Cross-Border Or EU-Related Disputes?

29% of the audience say Brexit led to more complicated legal frameworks in cross-border or EU-related disputes

Brexit affected various aspects of handling EU-related or cross-border disputes. Here’s what C-suite executives said:

Brexit had far-reaching ramifications, including affecting various aspects of how C-suite executives handle cross-border or EU-related disputes. With 29% of the audience naming more complicated legal frameworks, this was the area most commonly affected. 20.6% said that their dispute handling was affected by supply chain disruptions, while 13.8% said that Brexit made dispute resolution more complicated.

For 11.6% of the audience, Brexit complicated regulatory compliance, while 9.3% said that increased tariffs associated with the UK’s exit from the EU affected their handling of disputes. 5.9% said that Brexit made arbitration more complex, and 5.6% said that contract enforcement had become more complicated. According to 4.2% of the audience, more complicated trade agreements have affected how they handle and resolve cross-border or EU-related disputes.

Numerous UK businesses foresaw the possibility of Brexit affecting dispute resolution before Brexit. A 2018 Thomson Reuters survey found that 35% of UK businesses changed the dispute resolution clauses in their contracts ahead of Brexit. Of those businesses, 51% chose for disputes to be heard in EU courts, such as in France or Germany, rather than in UK courts. 20% said they would consider turning to arbitration as a method after Brexit.

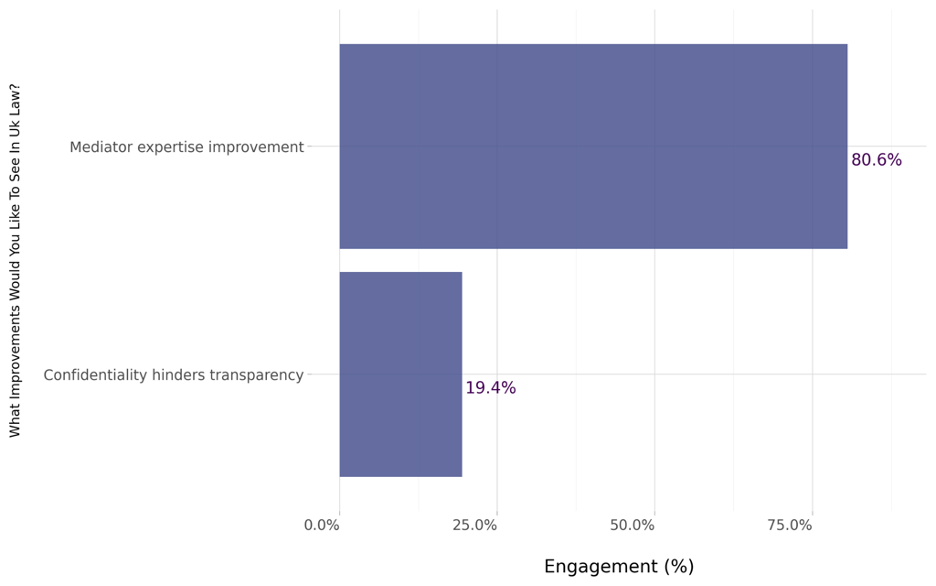

What Improvements Would You Like To See In UK Law?

80.6% of C-suite executives want to see improvements in mediator expertise

The graph below indicates the improvements that C-suite executives would like to see in UK law:

Historically, London has been a global centre for dispute resolution. While UK law, especially in this area, is among the world’s best, there is always room for improvement. 80.6% of C-suite executives said that they would like to see mediator expertise improve. 19.4% of the audience said that they would like to see changes that address what they see as confidentiality hindering transparency.

The majority of executives saying that they would like to see more experienced mediators is not entirely without justification. A 2023 survey by the Centre for Effective Dispute Resolution found that 76% of mediators described themselves as reasonably or very experienced, while 16% said they had some or limited experience. 8% of mediators surveyed said they were accredited but had no experience as a lead mediator.

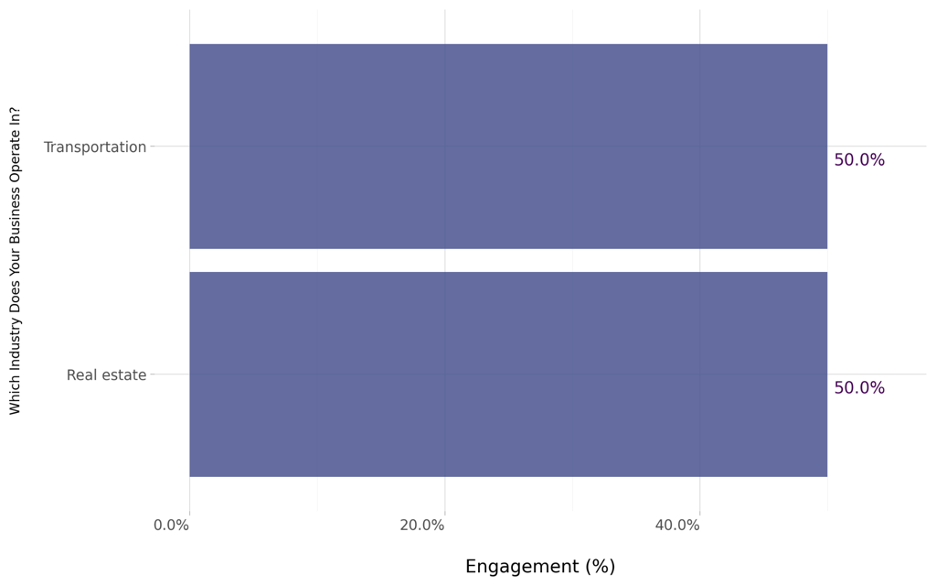

Which Industry Does Your Business Operate In?

50% of the audience’s businesses operated in the transportation industry

Find out which industries our audience’s businesses operate in with the graph below:

The C-suite executives in our audience were evenly split between two industries. 50% of the audience said their businesses operate in the transportation industry, while the other 50% said their businesses operated in the real estate industry. While only two industries were mentioned by the audience, these are by no means the only industries in the UK affected by disputes.

According to Statista, an estimated 7,000 workers in the UK were involved in industrial disputes in November 2024. This is a significant decrease from the approximately 306,000 workers involved in labour disputes in the UK in March 2023.

Commercial Dispute Trends

Commercial dispute trends have rapidly evolved in recent years, influenced by shifts in global markets, technological advancements, and changing legal frameworks. These are some of the most prevalent trends for 2025:

Expansion of Class Actions

While not mentioned specifically by the audience, class actions have become increasingly prominent in terms of litigation in the UK. Building on trends from previous years, 2023 and 2024 saw several large group actions move through the courts.

One such case saw 49 institutional investors in Boohoo Group Plc file a claim against the company for allegedly failing to disclose alleged labour rights violations in its supply chain – a failure that reportedly caused financial loss to the investors after Boohoo’s share price dropped by more than £1.5 billion after media reports detailed the allegations.

Claimants and litigation funders have actively pushed the boundaries of representative actions by seeking to address grievances collectively. This increase in class actions reflects a growing recognition of the efficiency and effectiveness of collective redress mechanisms in addressing widespread issues.

Increased Use of Alternative Dispute Resolution (ADR)

The use of Alternative Dispute Resolution (ADR) methods has increased in the UK as a result of a landmark judgement by the Court of Appeal in late 2023. The judgement in the case of Churchill v Merthyr Tydfil Borough Council overturned a long-standing prohibition on English civil courts directing parties to use ADR. This judgement cleared the way for courts to mandate ADR in appropriate cases and promoted greater collaboration in dispute resolution.

Growth in Litigation Funding

There was substantial growth in litigation funding in 2023 and 2024, providing claimants with the financial resources to pursue claims without being responsible for covering the upfront costs. However, the PACCAR decision, a Supreme Court ruling in July 2023, has significant implications for litigation funding agreements.

By deeming certain funding agreements unlawful, the ruling created uncertainty among claimants and potentially deterred grieved parties from filing claims. This development prompted calls for legislative action to address these challenges and to restore confidence in litigation funding.

Impact of Geopolitical Tensions

Geopolitical tensions increasingly influenced commercial disputes in the UK in 2024. Globally, geopolitics were further complicated by a record election year, with more than 2 billion voters in 50 countries heading to the polls, including significant elections in the US and India. These shifts exacerbated uncertainties in international relations, impacting businesses and other organisations engaged in cross-border activities.

These geopolitical tensions have led to an increase in disputes in commercial courts, specifically in cases related to regulatory changes, sanctions, and trade restrictions. For example, the ongoing war in Ukraine and tensions in the Middle East have led to a re-evaluation of existing contracts and business relationships, resulting in a surge of litigation.

The UK’s relationship with China has also been subject to greater scrutiny. Diplomatic tensions increased in 2024 after allegations of cyberattacks and espionage, leading to sanctions and other countermeasures that disrupted trade and investment. This, in turn, prompted a series of legal challenges as organisations contended with the implications of government decisions for their operations.

Technological Advancements Influencing Disputes

Technological advancements, especially in artificial intelligence (AI), have begun to influence dispute resolution. The last couple of years have seen an increase in litigators' and litigants' attempts to rely on AI in legal proceedings.

However, this trend has led to challenges, such as complications that arise during litigation because of too much reliance on AI-generated information. This highlights the importance of integrating technology into legal processes carefully, ensuring they enhance rather than hinder them.

Ratification of the Hague Judgements Convention

The UK made strides in enhancing the enforceability of its civil and commercial judgements internationally by ratifying the Hague Convention of 2 July 2019 on the Recognition and Enforcement of Foreign Judgements in Civil or Commercial matters. The UK deposited its instrument of ratification on 27 June 2024. The convention is set to enter into force for the UK on 1 July 2025.

The ratification is expected to streamline the process of recognising and enforcing UK judgements in other contracting states. This should reduce legal uncertainties and the complexity of cross-border litigation, encourage international trade, and further cement the UK’s reputation as a hub for international dispute resolution.

Emergence of ‘Mega Trials’

The UK’s commercial courts have seen a rise in ‘mega trials’, and new cases keep coming. Lawsuits worth a combined total of at least £83 billion have been filed in the High Court since the start of last year, including an insurance case involving aircraft stranded in Russia. These complex, high-value cases usually involve multiple parties and extensive legal arguments.

While these trials highlight London’s prominence as a global legal centre, they also present challenges such as an increased strain on judicial resources and the need for efficient case management strategies.

Additionally, the growing number of ‘mega trials’ is an indication of the continued evolution of commercial litigation in the UK.

Demographics

To better understand our audience of 25,708 C-suite executives in the UK, we unpacked the data to gain insights into their age, gender, and location.

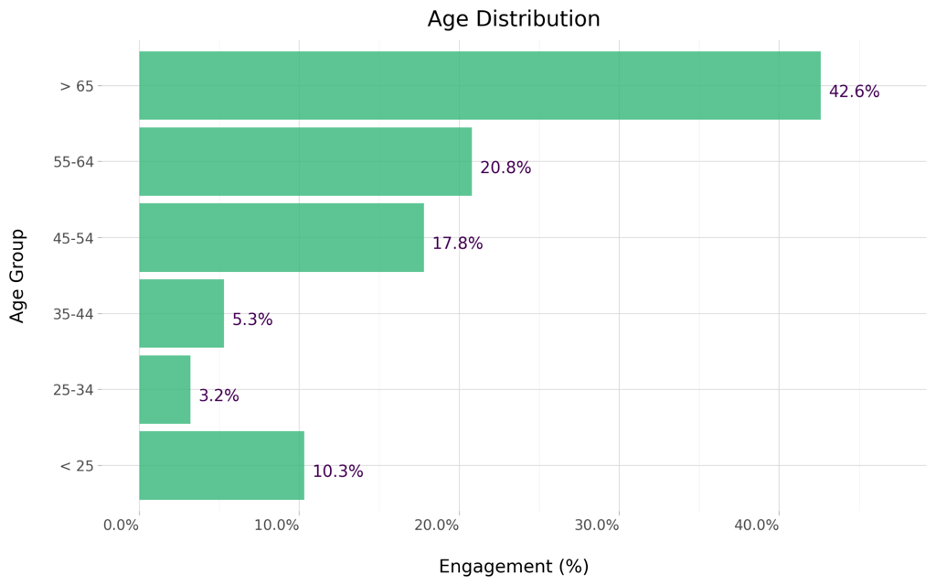

Age

42.6% of C-suite executives are 65 years old or older

More than 40% of the audience was aged 65 years or older. Take a closer look at the engagement levels of different age groups in the graph below:

The largest, most engaged age group in our audience of C-suite executives was the 65 or older group (42.6%), followed by those aged 55 to 64 (20.8%). The third next most engaged group was aged 45 to 54 (17.8%), while 10.3% of the audience was aged 25 or younger. 5.3% was in the 35 to 44 age group, while only 3.2% were aged between 25 and 34.

This is more or less in line with the 2024 UK Spencer Stuart Board Index, which revealed that the average age of CEOs has dropped to 55.6, while the average age of CFOs has dropped to 52.4 years, which is similar to what they were in the 1950s. The index also indicated that, while 20 CEOs are younger than 50, only five are 65 or older.

Gender

More than 62% of our audience of C-suite executives is female

As the graph below shows, women outnumbered male C-suite executives:

At 62.6%, women comprised the majority of our audience. Only 37.4% of the audience was male. This result was unexpected. According to research from Grant Thornton, only 22% of UK mid-market businesses had a female CEO or MD, while 40% of these businesses had a female CFO in 2024.

These results are also surprising, considering that our audience represented only two industries, namely transportation and real estate. The Chartered Institute for Logistics and Transport revealed that only 23% of the transportation industry’s workforce is female, more than half of whom work in non-transport roles. According to Statista, there are 198,000 women working in the UK’s real estate sector, compared to 190,000 men.

Where Is Your Organisation Primarily Based In The UK?

41.8% of the audience’s organisations were based in Glasgow, Scotland

Our audience spans the length and breadth of the UK. Find out where their organisations are based in the graph:

With 981,000 SMEs, London was the region with the highest number of these organisations in the UK in 2024, according to Statista. Surprisingly, the capital was not mentioned by our audience of C-suite executives. 41.8% of our audience said their organisations were based primarily in Glasgow, while 21.6% were based in Birmingham. 18.7% were based in Sheffield, while 6.4% were based primarily in Edinburgh. 5.6% of the audience said their organisations were based mainly in Leeds, and 4.1% named Cardiff as their organisation’s main base in the UK. Only 1.8% said their organisations were based in Liverpool.

Overall, these commercial dispute statistics highlight a significant preference for mediation as the primary dispute resolution method despite litigation remaining a common approach. At Dutton Gregory, our commercial dispute resolution solicitors are adept in all forms of mediation, arbitration adjudication, and litigation and provide fast and professional advice to resolve disputes as quickly and cost-effectively as possible. As disputes are on the rise, both in number and size, these services are primed to become more valuable than ever.

About the Data

Sourced from an independent sample of 25,708 c-suite executives in the UK from X, Quora, Reddit, TikTok and Threads. Responses are collected within a 65% confidence interval and 11% margin of error. Engagement estimates how many people in the location are participating. Demographics are determined using many features, including name, location and self-disclosed description. Privacy is preserved using k-anonymity and differential privacy. Results are based on what people describe online — questions were not posed to the people in the sample.